Despite the continued good performance, it seems that the debate over the appropriate value of the entertainment industry will continue this year, following last year. This is because many investors are concerned about the possibility of negative growth in industry indicators (album sales) due to the absence of Big IPs and the uncertainty of the success of new global IPs. In the future, balanced and rapid growth of both Core Fandom and Norm Core popularity is important for the K-Pop industry. Although BTS, which achieved success in both of these axes, is absent, if we focus on the growth of the existing ones rather than the absence, the perspective can change. Notable examples of the growth of existing ones include “Stray Kids” and “New Jeans.” Stray Kids is expected to achieve the same results as BTS in its fifth year by recording 7.5 million album sales (assuming 4 million total album sales + 3.5 million album sales in Japan in February and Korea in March) in its fourth year since its debut.

New Jeans have entered the UK Official Singles Chart with just their second album and are close to entering the US Billboard Hot 100 chart.

Since the beginning of the year, entertainment has been one of the most damaged industries in the stock market. Of course, there has been some sentiment damage since November of last year due to the controversy over the peak-out of the album. This requires some patience and time because we need to confirm through future quarterly performance that . Even excluding this, it is largely due to being completely excluded from the market theme. This is because it was not applied to any of the AI and current low PBR themes at the beginning of the year. Momentum was also in a lull. Most of it was a season where concerts were held, so there was no positive news/issues. Since it was an industry where supply and demand were very tight, it was an industry where only supply and demand were lost while moving within limited funds. Conversely, the entertainment industry is clearly an ‘oversold’ sector. Since only supply and demand were taken away, it is clearly undervalued compared to its original fundamentals. Can the ‘entertainment triple disaster’ be resolved?

There are three positive signals. First, Twice’s album sales, which came back on 2/23, increased compared to the previous album. If there had been a steady decline for every artist making a comeback, this is the first time in a long time that they have increased, overcoming the . Second, HYBE has revealed very meaningful music/streaming results. Until now, HYBE has released albums + music combined, making it difficult to grasp the music numbers alone, but they provided them in detail through the 4Q23 performance announcement. Music sales in 2023 are 297.8 billion won, growing 79% year-on-year, and a CAGR of +38% over the past two years. The sales ratio increased from 12% in 21 ⇒ 9% in 22 ⇒ 14% in 23. It seems that music/streaming has been chasing the exponential album sales and sales performance that has only occurred in Korea over the past three years at the same speed. The composition is 40.5 billion won in domestic sales of artists affiliated with HYBE’s labels, 107.1 billion won in overseas sales, and 150.2 billion won in sales of artists affiliated with US labels that HYBE has acquired. Looking back at HYBE’s music performance, it seems like NewJeans/BTS groups and soloists would take up the majority due to their overwhelming music performance, but that is not the case. No matter how much K-POP becomes mainstream in the music/streaming industry, the performance created by overseas artists in the US pop, country, and hip-hop genres in global music is much greater. Just comparing the number of paid streaming subscribers, it is about 20 million in Korea vs. 1 billion worldwide. This is why HYBE continues to actively pursue global music/regional expansion. The clear implication is that even if album sales decline/stagnant, the high growth of global music/streaming will allow for an upward trend in the performance of the music (album/music) division, and if music/streaming surpasses album sales in the future, margins will improve. Third, the momentum lull is also gone. In Q124, since entertainment companies generally have a quiet time, the lack of good news is scarier than malicious comments, which was one of the factors in the entertainment industry’s adjustment. However, the continuous activity momentum from is expected to expand from Q124 to Q24.

Currently, a new investment point is needed in the entertainment industry. This is to refresh the sentiment buried in albums. A new perspective on Japan was also presented. Since the long-standing and traditional local entertainment company (Johnny’s) and the local idols affiliated with it are collapsing in large numbers, there is a possibility that Korean entertainment companies can dig deep into the gap.

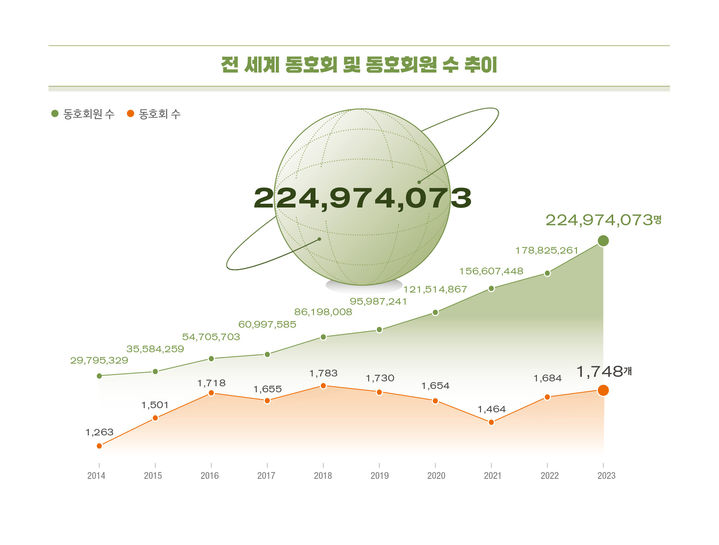

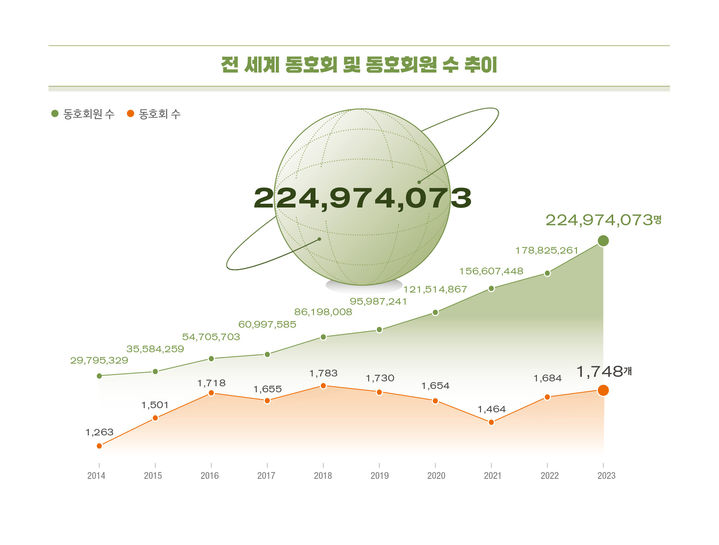

The TOP 10 of the Oricon chart has been dominated by K-pop artists, but even then, the top rankings were adorned by Japanese local idols. However, as they gradually collapsed, the development of the next IP and generational change were not smooth. The possibility that Korean agencies could fill this gap has been raised. This cycle is not about just starting planning and debuting in the next 2-3 years. Korean agencies have even completed all the preparations. In the past, artists who debuted in Korea would debut in Japan and expand their areas of activity, and up until now, by forming Japanese members within the group, they have been able to advance into Japan more smoothly. That’s what has now come to be the launch of Japanese ‘local’ artists wearing the K-POP training system. Considering that there is already a successful case of JYP Ent.’s Japanese girl group NiziU, and that the local idols that are currently declining are boy groups, the Japanese boy group <&TEAM> of HYBE that debuted at the end of 2022, the Japanese boy group of JYP Ent. that debuted at the end of 1Q24, and the Japanese boy group of SM that debuted on 2/21 could be the best alternatives to fill the declining Japanese music market. Why were so many K-POP singers invited to fill the stage of NHK’s Kohaku Uta Gassen at the end of last year? How was SM’s Japanese boy group able to hold their first debut showcase at Tokyo Dome? Just thinking about these concerns, it is clear that Japan’s supply (broadcasts, concert halls, etc.) is also favorably directed towards us. Japan is the world’s second largest music market, and has already been recognized in the stock market as a market with very smooth profitability. If there was no Japan, there would have been no China or the United States in the first place. A more intense and evolved form of penetration in this market would be an important investment point for entertainment stock profit growth. Meanwhile, the derating that started with the decline in Chinese tools and platform albums continues. The lowest point of Hybe’s valuation was the moment BTS’s military enlistment video was released, and it fell to a P/E of 22x for the next year, which was a discount to JYP at the time. Despite the increase in profits, JYP’s P/E was 16x in 2018, the only time its annual stock price fell due to the GSOMIA (No Japan) issue. It is currently trading even lower than this, and the foreign ownership ratio also fell from 39% to 34% in one month due to the album downgrade and MSCI exclusion issues. In the case of SM, there was a period where TVXQ’s military enlistment and the Korean Wave ban overlapped, and the P/E was around 16x at the time of TVXQ’s discharge. The current valuations of the four entertainment companies are HYBE 26x/19x (BTS comeback in the second half of the year), JYP 16x/15x, SM 13x/12x, and YG 23x/12x (all Blackpink) in 2024 and 2025. De-rating is inevitable due to the decline in albums, the most intuitive indicator, but most of the major artists’ album downgrades will be confirmed with NCT Dream’s comeback scheduled for March 25, and starting from April, groups that have already reflected the decline in albums will make comebacks, starting with TXT. The combined operating profit of the four major entertainment companies is expected to be around 80 billion won in the first quarter and around 220 billion won in the second quarter, with HYBE/JYP’s highest operating profit ever. This is due to the concentrated comebacks of major artists in the second quarter before the Summer Olympics in July and August. Although there is little expectation for album growth in the second quarter, if it does not decline as sharply as in the fourth quarter, it is insensitive to favorable factors such as Twice’s No. 1 on the Billboard 200 and Le Seraphim’s entry into the Billboard Hot 100, but it is expected that there will come a time when it will become insensitive to unfavorable factors at the current valuation level that has surpassed a 20% downward trend compared to the past. There are no major issues with the profit outlook this year either. There are concerns that the decline in albums will lead to negative performance growth, but that is quite unlikely. Considering only the release of Cat’s Eye’s Netflix documentary and debut in the summer, HYBE is expected to improve its OP by at least 30 billion won this year compared to last year. There will be additional upside with Ariana Grande’s comeback and tour visibility, and the release of in April. JYP’s considerable Japanese tour revenue from the fourth quarter was carried over to the first quarter of this year, and many comebacks, tour expansions, and the debut of three teams will follow this year compared to last year. SM’s performance was also sluggish due to the aftermath of the dispute in the first half of last year and the big bass in the fourth quarter, but it will increase as management is warming up, with the tour scale already approaching 700,000 people in the first quarter of this year. For YG, the successful debut album performance of Baby Monster is important in resolving its dependence on a single IP. Overseas fandom: Growth in size due to expansion of local activities and organization of overseas fandom The fandom size is expected to grow in 2024 and the purchasing power of the fandom is expected to grow in 2025. The phenomenon of organizing overseas fandoms, which was limited to a small number of groups in the past, is spreading to all K-pop groups. In fact, most artists from the four major entertainment companies, such as BTS, Blackpink, Seventeen, and Skiz, who are well-known overseas, as well as rookie groups New Jeans, RlIZE, and Bodo, are in the process of organizing their overseas fandoms. However, the current organization stage of overseas fandoms excluding China is in its initial stage, and it is difficult to expect a short-term increase in purchasing power. This is similar to the appearance of domestic fandoms in the early 2010s, where competition between fandoms is not observed and promotion through secondary creations is the main activity, and it is a period of growth centered on the size of the fandom. In the domestic fandom, competition between fandoms intensified in the early 2010s, and initial competition began for the first time. Along with this, album sales began to grow rapidly. Competition between overseas fandoms is expected to form in 2024, when localization groups begin to operate in earnest. In 2024, overseas fandoms are expected to grow based on size rather than purchasing power. This is because local activities such as overseas concert tours and pop-up stores are expected to expand, and synergy effects are expected from the continuous promotional activities of organized overseas fandoms. It is expected that overseas fandoms will see full-scale growth in purchasing power in 2025. The key factor in increasing purchasing power in fandoms is competition within the fandom, and competition is expected to become full-scale through localization groups. In the US, YP’s VCHA and HYBE’s Hats Eye are scheduled to make their official debuts in the first half of 2024, so it is a time to build initial fandoms rather than compete between fandoms. In Japan, the number of localized groups is expected to increase from 3 teams based on the existing 4 entertainment companies to 5 teams in 2024, which is expected to intensify competition between fandoms. Domestic fandom: Size and purchasing power to continue to grow along with popularization of fandom activitiesThe combined domestic and international core fandom is expected to continue to grow to 4.5 million (YoY +20%) in 2024. According to Aladdin’s statistics on music consumers sold in 2023, the combined proportion of people in their 20s and 30s with high purchasing power based on the 4 entertainment companies increased to 46.9%. As the proportion of idols renewing their contracts has significantly increased from the previous magic 7 years, the lifespan of fandoms has also increased, and the age group of fandoms seems to have expanded along with it. In addition, the perception of fandom activities has improved significantly, and it is now in the process of being recognized as a healthy hobby. Therefore, the domestic fandom size is expected to continue to grow in 2024 as the existing fandom size is maintained at a certain level and new fans are introduced due to the popularization of fandom culture and the young fans following the debut of new artists. In particular, as fandom activities are recognized as a hobby, the amount of consumption is likely to naturally increase. While the average monthly leisure expenses in Korea are 176,000 won and in the US about 300,000 won, the average monthly consumption per core fan is about 90,000 won as of 2022. We estimate that the average monthly consumption of light fandom is less than 50,000 won. In general, the combined domestic and foreign fandoms are expected to continue to grow to 4.5 million core fandoms (YoY +20%) in 2024. In addition, as 10 teams are scheduled to debut in 2024, the influx of new fandoms is also expected. What is noteworthy is the growth rate of the fandom size of low-level IPs. The YouTube public channel operation and the trickle-down effect of senior fandoms are creating an environment where newcomers can form core fandoms. Based on the debut year of Espa, the annual average is 43%, Newjins 102%, and Enmix 75%, showing a trend of rapid core fandom formation. Album: In terms of the growth of album sales in 2024, it is necessary to pay attention to the growth of album sales of low-ranking IPs rather than the growth of junior mega IPs. In 2023, there was a large growth centered on the expansion of album sales of mega IPs such as Seventeen and Stray Kids. Even considering the growth of fandoms, from a conservative perspective, the growth of album sales of mega IPs in 2024 is expected to slow down. However, album sales in 2024 are expected to grow by +6.2% compared to 2023, centered on low-ranking IPs. This is because the average album sales of 4th generation idols have grown by about 133% for each period of activity, and the absolute size has also reached a significant level. Looking at the sales of new artists’ albums, the period to reach 1 million copies sold is getting shorter and shorter, and the contribution of new artists is by no means low. With 10 new teams scheduled to debut in 2024, growth is expected to continue even considering the hiatus of BTS and Blackpink. This is because an environment has been created where initial fandoms can be formed quickly. The effect of exposure through uploading music videos and various teaser videos to the entertainment company’s shared channel has expanded the fandom trickle-down effect, and the entertainment company’s improved overseas network and negotiation power are expanding opportunities for overseas stages. As the popularity of K-pop artists in the West has been confirmed in 2023, the negotiation power with local promoters is likely to improve. Accordingly, it is expected that local activities such as overseas showcases and broadcast appearances by new artists will be actively carried out. The initial fandom formation environment is expected to continue to develop in 2024. Performances: Growth expected to continue despite decrease in number of attendees due to mega IP hiatus As the popularity of K-pop overseas concerts in 2023 is verified, P and Q growth is expected in 2024. The number of concert attendees in 2024 is expected to decrease by -1.4% year-on-year due to BTS and Blackpink’s hiatus. Due to increased P (guarantee) due to increased negotiating power and significant Q (attendee) growth for artists excluding the two artists, the performance sector based on the four major entertainment companies is expected to increase by +13.7% to KRW 705 billion by 2024 compared to 2023. First, the scale of rookies’ first concerts has expanded significantly. In the past, overseas tours centered on Asia have now become possible in the West, and the scale of rookies’ first concerts continues to grow. Second, the first cycle of concerts that resumed in the second half of 2022 after COVID-19 has finally ended. Since the scale of concerts is determined several months before the performance, it has not fully reflected the high growth in 2023. Accordingly, in 2024, both the number of performances and the number of attendees per show are expected to increase, reflecting this growth. Third, the most anticipated sector is the growth of guarantee (P). It is highly likely that the overall guarantee will continue to increase for K-pop artists who have sold out all tickets and recruited additional performances. As the fandom size expands and demand overwhelms supply, HYBE, which recognizes performance revenue as total sales, is most advantageous. Sales in the performance sector are expected to grow +23.4% year-on-year in 2024. In the case of JYP Ent., it is expected to record the highest performance sales growth (YoY +56.2%) in 2024 due to its contract with Live Nation, which allows it to share a portion of the profits from its US tours. 2024 MD: Highest growth expected due to regional expansion with overseas pop-up stores It is expected to record the highest growth rate with MD sales of KRW 909.1 billion (YoY +28%) in 2024. The combined MD sales of the four Coverage Entertainment companies in 2024 are expected to reach KRW 909.1 billion (YoY +28%). Performance-related MD sales are expected to grow due to the popularity of performances, and this is expected to be due to the popularization of regular MD and the introduction of a seasonal system. Unlike the album and performance sectors, the MD sector will show the highest growth due to the addition of fandom to general consumption. Pop-up stores are showing extremely long waiting times and the fact that all goods are sold out early, showing that demand is overwhelming supply. The proportion of foreigners is increasing, as peddlers who used to buy cosmetics at duty-free shops are seen at K-pop artists’ pop-up stores, showing that their purchasing power is quite high. (Established as one of the tourist attractions) Popularization of MD In the past, MD was mainly consumed by fandoms due to the concept of fans’ collections, but the current MD is targeting the general public and greatly expanding MD items. In addition, as exhibition-type pop-up stores are expanding, accessibility for the general public is also improving. The trend is to hold pop-up stores for each artist’s album promotion period, and each time, they are composed of a different theme. Since MD products of the corresponding season are sold for a limited time, their rarity has increased, and some MDs are traded at a premium on the resale platform Cream. The company expected to show the highest growth in the MD sector is HYBE. It is leading the expansion and popularization of MD types, and it is expected to grow +44% YoY through overseas pop-up stores in 2024. There are differences by entertainment company, and it is also necessary to consider the time difference in which overseas sales are reflected. Although it cannot be completely free from recent noise, HYBE has many artists who have demonstrated expanded performance in the second half of last year. “Seventeen, Tomorrow x Together, New Jeans, Enhypen” and others have achieved solid results. SM has proven its presence with active activities such as “NCT Dream, Espa, NCT 127, EXO,” and MP has shown good performances led by Stray Kids, Enmix, and Twice. YG Entertainment was poor in terms of album sales due to Blackpink’s focus on world tour activities, but they were outstanding in terms of performance performance. The initial sales volume that led the recent industry boom unfortunately decreased compared to the previous album, but there were also artists who clearly grew. Artists who expanded their global fan base through world tours, etc., rather than being concentrated in a specific region, continued the growth curve. As the proportion of overseas fans has increased compared to the past, there is a time difference in reflecting overseas sales and delivery, so it is necessary to watch it over a longer period than a week. For reference, Hanteo Chart, which is used as a measure of initial sales volume, can calculate sales volume in real time because it calculates based on domestic retail channels and franchises, but overseas local sales volume is not completely calculated. On the other hand, Circle Chart checks the return volume on a weekly basis, so real-time calculation is difficult, but since overseas volumes such as Japan and North America are also reflected, it is understood as a figure close to the actual sales volume of the agency. In the case of artists with large fandoms in the US and Japan, overseas sales volume is reflected with a time difference, so the volume that is not reflected in the first week is also increasing. As the entertainment industry expands and the size of overseas fandom grows, it is natural that the proportion of overseas sales increases, and accordingly, it is necessary to judge whether the performance has expanded after at least 2 weeks to 1 month. According to the Korea Customs Service’s import and export trade statistics, overseas album exports in 2023 increased by 25.5% compared to the previous year. By major country, Japan increased by 41.8%, the United States by 61.1%, and Southeast Asia and Europe and other countries increased by 33.8% during the same period, while album exports to China decreased by 33.8% to $33.99 million. Although concerns about a decrease in tool sales in China still exist, the proportion has decreased significantly compared to the past, and the fan base in the industry as a whole has diversified and expanded by region. As artists who have just debuted and artists who have been in their first or second year are expanding their scope of activities and expanding their fandom from Korea to overseas, it is expected that the growth of younger artists will be able to sufficiently offset concerns about the album purchasing culture in certain regions. Diversifying revenue sources for entertainment companies It cannot be denied that the main growth axis of the Korean entertainment industry from 2021 to 2023 after the pandemic was ‘albums’. The domestic entertainment industry is considered to be going through a transitional period, and this year is expected to be a major turning point. It is expected that there will be gradual diversification as the axis of revenue changes from albums to music sources, performances, IP licensing, advertising, and digital content. In particular, top-tier artists with expanded fandoms and increased popularity are expected to lead the simultaneous growth of performance sales and MD sales through tours. It seems that fans who were unable to express their feelings in person during the pandemic will be expressed through offline performances, and in addition, local album releases that are not included in domestic charts are also increasing. Last year, Stray Kids’ first EP album released in Japan received a million (over 1 million copies) certification from the Recording Industry Association of Japan, and Seventeen’s first best album also received triple platinum (over 750,000 copies). As the scale of performances expands, MD growth such as cheering sticks is also expected to follow, and significant growth is expected this year. In 2017, music sources overtook the physical album market as the main method of music consumption in the global market, and the axis of growth has changed. As domestic artists have expanded the scope of their popularity, they have begun to capture not only their existing fandom but also the general public, and the proportion of music sources in entertainment companies’ album sales has increased to 25-35%. The global music streaming market is expected to grow 15% year-on-year this year, and domestic entertainment companies are expected to show a growth rate that exceeds this by increasing their share of the music market. Artists with high public awareness are expected to expand the radius of their sales through advertisements utilizing this and various profit activities utilizing IP. Although there are differences by country, the venues where artists hold concerts are divided into stadiums (approximately 70,000 seats), domes (approximately 50,000 seats), super arenas (approximately 30,000 seats), arenas (10,000-20,000 seats), and halls (approximately 5,000 seats) depending on the number of seats. In 2024, the number of performances is likely to increase compared to the previous year, but as the ‘weight class’ of the performances increases, the growth in the number of audiences per performance is expected to be the main factor in the growth of tour sales. New artists waiting to be launched to inject new vitality New artists currently being prepared by major entertainment companies are preparing to debut. Each company is preparing to attack the market with differentiated concepts, genres, and debut strategies. Pledis Entertainment (HYBE) launched the six-member new boy group ‘TWS’ for the first time in nine years since Seventeen, and they got off to a splendid start by selling over 260,000 copies of their debut mini-album. Following this, JyP’s American girl group VCHA, one of the localized groups to watch this year, released their debut single, and in February, SM NCT’s last unit ‘NCT WISH’ made its official debut. The promising group ‘Baby Monster’, who made a splendid debut in November last year, is expected to release their second single in February and make a comeback as a complete group with member Ahyeon joining in April along with the release of their album. In addition, CJ ENM is expected to launch the global girl group project ‘-LAND Season 2’ on Mnet starting in April and launch the formed group in the second half of the year, and the girl group ‘ME:’ that was formed through ‘Produce 101 Japan the Girs’ in Japan late last year will debut in Japan in April, leading to the expansion of Laphone Entertainment’s lineup. In addition, Cube, F&F Entertainment, WM Entertainment, RBW, etc. are preparing a lineup of new artists. Since new artists tend to have a short comeback cycle in order to secure a position in the market, there is a high possibility that new artists who debuted in the first half of the year will be active in the market in the second half as well. It is necessary to keep an eye on the initial performance and growth rate of new artists. Localized Group Debuts in Full Swing The Korean entertainment training system is being introduced overseas, and localized artist training consisting of members of the local nationality is in full swing. The debut of artists who are called K-POP without K is expected to increase significantly this year. In Asia, including China and Japan, leading domestic entertainment companies such as JYP, HYBE, SM, and CJ ENM have already formed localized groups and achieved good results. In Japan, SM’s boy group ‘NCT WISH’, JYP’s boy group ‘NEXZ’, and Laphone Entertainment (CJ ENM)’s girl group MET have been confirmed to debut, and HYBE is also planning to debut additional groups locally, so it is expected to accelerate its penetration into the Japanese market based on its already secured know-how, local network, and planning capabilities. The most notable market this year is, of course, the United States. Two girl groups, IP’s VCHA and HYBE UMG’s ‘KATSEYE’, scheduled to debut in the first half of the year, will be unveiled. JYP is joining hands with Republic Records, and HYBE is expected to focus on the US market and begin full-scale activities by collaborating with Geffen Records. VCHA is expected to increase awareness by appearing on the opening stage for TWICE’s concerts in Mexico, Brazil, and the US, and is also expected to explore appearances on local radio and other broadcasts. KATSEYE is expected to increase its presence in the market by airing a documentary about their growth story through the global OIT Netflix at the time of their debut. The US music market is the largest in the world and is quite important, so they will expand their growth sources through localization. Given the characteristics of the US market, rather than a short-term response, they are expected to gradually prove their growth potential this year and expand their potential through collaboration with local partners. HYBEHYBE’s 4Q23 performance was close to the market’s expectations, with sales of KRW 608.6 billion and operating profit of KRW 89.3 billion. They recorded the highest quarterly profit as expected, with figures increasing by +14% and +76% year-on-year, respectively. were reflected. However, net profit recorded a deficit of 54 billion won due to valuation loss caused by the decline in SM’s stock price and depreciation of acquired overseas labels. Weverse, which has been controversial every time it announces its performance, has improved significantly. MAU is stably maintaining 10 million, and the number of communities participating has expanded from 71 at the end of 2022 to 122 at the end of 2023. Above all, it was mentioned that the timing of Weverse monetization, which the market is curious about, is within this year. The first dividend (DPS 700 won) was also paid. The dividend payout ratio is around 15%, and although it is a growth stock that still requires investment, the dividend was decided relatively early, and the plan is to ultimately increase the dividend payout ratio to 30%. In the most important main business, Hybe, the leader, also received the most market pushback on the ‘album decline’. While it is true that album sales in the market are decreasing due to the overall decrease in Chinese consignments and weakening competitiveness of K-pop fandom in Korea, Hybe’s core fandom is still growing when looking at the increase in the number of buyers. Considering the overwhelming high growth of global music/streaming compared to other companies, the upward performance trend of the music (album + music) business division seems to be reasonable. Even if albums stagnate, Hybe, which is actively pursuing global music/regional expansion, can overcome the crisis with the high growth of music/streaming, and if music that does not entail offline distribution fees surpasses albums in the future, it is expected that it will be able to improve the margin even more. As album consumption is being dispersed and expanded to other things such as concerts/goods/appearances/platforms, the related scale will grow even larger in 2024, and additional revenue such as games, content, and Weverse monetization utilizing IP will also expand. Following the successful debut of TWS on January 22, the artist lineup includes girl group on March 25 and American girl group in preparation for 2Q23. Following BTS Jin in June, J-Hope will also return to the lineup in the second half of the year after his military discharge. Although the starting point will be 1Q24 due to the period of activity, there will be significant increases in 2Q24 and 4Q24, so there will be no change to the estimate of double-digit annual profit growth. Hybe’s consolidated sales and operating profit for the fourth quarter are estimated at 433.4 billion won and 50.3 billion won, respectively. Operating profit is expected to have slightly fallen short of market expectations, due to the reflection of employee performance-based bonuses, costs related to the debut of an IP in Japan, BTS’s no-guarantee concert, and some IP low-profit tours. However, due to the release of BIS Solo and Seraphim new albums, sales of other IPs, BIS photobooks, Seventeen’s Japanese dome tour, and MD-linked sales from the main 4th generation IP tour, it seems that the absence of BTS as a whole will not have a significant impact on the overall appearance. Last year was a time to consider the extent of discount due to the absence of BTS as a whole IP when estimating the company’s performance or granting multiples. However, even in the last 4th quarter performance, it is expected that the absence of BTS as a whole will not have a significant impact on the appearance, and this trend is expected to continue throughout this year. It seems that this year will be a year in which the “gains” will be more noticeable than the gains, due to the growth of 4th generation IPs, the introduction of the Weverse subscription model expected in the 2nd quarter, and the release of publishing games. (The introduction of the Weverse subscription model is expected to be in the 2nd quarter) The granting of multiples may vary depending on the MAU trend after Weverse becomes paid. SM Entertainment’s consolidated sales and operating profit for the 4th quarter are estimated at 230.8 billion won and 20.8 billion won, respectively. It seems to have met market expectations, but the operating profit rate is estimated to have decreased compared to the previous quarter. Cost control efforts were effective as in the previous quarter, but this is because the employee performance bonus was reflected at once. In the main business, the release of new albums by Red Velvet, NCT Dream, etc., and performances by NCT 127 and NCT Dream contributed to the performance. It is estimated that affiliated subsidiaries such as Dream Maker, Japan, and C&C also recorded performance exceeding the BEP level as in the previous quarter. SM recently announced that it would increase the proportion of outside directors from the current 25% to the majority and change the chairman of the board from the CEO to an outside director to strengthen the independence of the board of directors. Prior to this, it announced the early termination of the producing contract with Like Planning last year. Although not all of the contents that major shareholders have been demanding have been reflected, it is certain that there is a gradual change from “Korean standards” to “global standards.” Last year, the company’s production contract was completed, but it is expected to reflect the cost until the completion of some projects (ASPA comeback albums, etc.). It is also estimated that the company’s four -quarter sales are estimated to be the highest performance in the fourth quarter. There are about 4.8 million albums, and in the third quarter, NIZIU’s Japanese dome tours were reflected in the first quarter of this year. In the future, the K-POP industry is important to see how fast and balanced the core core axis grows than the BTS of Stray Kids, which is the representative IP of the NORM CORE. The results of the rapid growth of the stray Kids have also been raised. Oject C/China Male, NIZIU BOY/A2K Project/US Women’s Woman is the first year to expand the lineup last year, but it is more likely to grow under the IP emissions and positive System. We gather. YG’s consolidated sales and operating profit were estimated to have been estimated to have been estimated to have been estimated at W147.4bn, respectively. It is estimated to be the first quarter of the company’s main IP and new IP schedule. In the beginning of the year, the company released a new girl group, “Baby Monster,” which has been waiting for more than two years. It is noteworthy that the group’s flagship IP strategy, which leads to <2NE1 → Black Pink → Baby Monster>, will be effective this year. And another new IP will be expected.